Throughout the home buying process, you are going to hear many terms that you may not be familiar with. A Realtor may talk to you about a home’s value or about what they found doing a CMA, comparative market analysis. Your lender might talk to you about your debt-to-income ratio or the latest mortgage interest rates.

Fortunately, you don’t need to know all of these terms in order to purchase a home. But there are a few that you should be keenly aware of, even before you talk to a lender or Realtor. Here we’ll discuss one in great detail: the down payment.

Most people have heard the term down payment. Many of us have actually used a down payment in the past, potentially not really knowing what we were doing, why we were doing it, or if we could have done it better.

Now is the time to become an expert on what a down payment is, why you may want to put one down, how you can go about paying a down payment, and exactly how much it should be.

Down Payment on a House: How Much Do You Need?

It is not surprising that 86% of all home purchases across the country are done with the use of a down payment.

Unfortunately, many of those people who used a down payment didn’t truly understand what they were doing. They were just told that they needed to save enough money for a down payment in order to be able to purchase the home that they wanted. Not knowing the ins and outs of a down payment can hurt you when it comes time to decide how much you should put down.

First, let’s get familiar with the basics.

What Is a Down Payment?

Investopedia defines a down payment as a payment made in cash at the onset of the purchase of an expensive good or service. It represents a percentage of the purchase price and is not refundable if the deal were to fall through because of the purchaser.

When putting a down payment on a home, you are essentially buying an equity stake in the value of that home. This money is non-refundable, should you default on the loan, but it can protect you against home prices receding in market downturns.

Most loan products will require a down payment of some kind. This leaves the borrower with “skin in the game,” rendering them less likely to default since they know they’d be losing out on the non-refundable money they have already paid. All this creates a slightly less risky situation for the lender.

While there are many large purchases that use a down payment, such as purchasing a new car, we will be focusing on home purchasing for the duration of this article. When it comes to purchasing a home, on the day of your closing, you may need to bring more to the table than just your down payment, though.

Why, you ask?

A down payment is not the whole amount that will need to be settled with your closing attorney, or title company, at the time of your closing. In fact, there are other costs to purchasing a home that you may elect to pay in addition. These are commonly referred to as closing costs.

Down Payment vs. Closing Costs

It’s no secret that there are many hands in the pot when it comes to real estate transactions. It is at the time of closing that all of these hands want to get paid for the services that they provided throughout the home buying process. These are part of your closing costs.

Closing costs vary, sometimes wildly, from county to county (let alone state to state). But if you have purchased homes across the country, you will see a lot of the same items listed that need to be paid at closing.

Sometimes you can have your closing costs wrapped into your loan or negotiate with the seller to pay some or all of the costs for you. But more often than not, closing costs are going to fall on your plate. It is worth noting, that the seller and buyer will each have their own closing costs to be paid, as well.

When you combine your closing costs with your down payment, this is commonly referred to as “cash due at closing.”

What Is Included in Closing Costs?

Just as you wouldn’t want to pay for a meal before checking the receipt to make sure you were charged correctly, you probably don’t want to show up on the day of your closing without knowing all the costs you will be responsible for.

Fortunately, there is a little document that lenders are required to give you at least three days before your scheduled closing. This is called a closing disclosure document. This disclosure can be tricky to understand if you haven’t studied up though (so read on!).

Making Sense of Closing Disclosures

The closing disclosure is a breakdown of every cost included in your home purchase. You are going to see all sorts of fees and payments included in this document.

Some will be going to the county in which the home is located or to the closing attorney (or title company) that is preparing the transaction. The disclosure will also show any services that you were required by the lender to get, such as an appraisal or termite inspection.

You want to go through these disclosures thoroughly and make sure that the lender has not made any mistakes. After all, they are human, too. This is your best chance to get any necessary changes made before the closing date.

You should verify that all personal information is correct and that any arrangements made between you and the seller—or between you and the financial institution that is doing the lending—are shown on this report. For example, if the seller said they were going to credit you $1,500 for repairs that need to be made, that should be shown on the third page of the report as a closing cost to the seller. This is something that you will want to verify.

Keeping Records Throughout the Home Buying Process

It is highly recommended that you keep track of any expenses you make during the home buying process. By keeping records payments you have made, you will be able to verify all charges incurred on your closing disclosures are accurate.

You also want to make sure that you aren’t getting charged for something that you have already paid for. I have had closing disclosures come to me with payments for services, such as appraisals or inspections, that I had already paid out of pocket. If I hadn’t kept track of this, I may have ended up paying twice for a single service.

Estimating Closing Costs

Most lenders are able to estimate closing costs for a home given its price and location. But you can always refer to a closing costs calculator if you want.

A lender has specific costs that go into every closing, including origination fees for the loan, application fees, and underwriting fees. Then, there are costs that they see all the time like appraisal and inspection fees. Plus, there are the costs that they have to estimate, like property taxes and insurance. At this point in the process, however, you should know how much your insurance is going to be.

Negotiating Closing Costs

While you cannot negotiate your closing costs with the county collecting taxes, you can negotiate with the seller. We will cover some tips on how to make an offer more desirable to the seller and buyer later in the article.

How to Pay Your Down Payment

Unfortunately, not all of us have saved up—or will be able to save up—enough money to put toward the down payment on a new home. For those of us that fall into this category, you do have some options.

Can a Down Payment Be a Gift?

Yes, it can! However, there are some issues with monetary gifts that you will want to be aware of, even though they mainly apply to the gifter, not the giftee.

Down Payment Gifts Come With Rules

Just getting accused of committing mortgage fraud would be bad, but actually committing it would be worse. So, you must pay attention to what’s legal and what’s not when it comes to receiving a down payment as a gift.

There are more requirements, but you will need to have a signed letter that confirms your relationship with the person who is gifting you the down payment, stating that it is in fact a gift. At no point are you allowed to repay the gift—as that would be considered a loan and would may be considered mortgage fraud.

Another thing to be aware of is moving the money around well ahead of time. This is something that your lender will probably make sure happens, but the banks want to be able to trace the money that is being gifted to you for your down payment. They do this to ensure that it is coming from a legitimate source.

How Much of a Down Payment Can Be Gifted?

In most circumstances, you can receive a gift for the full amount of your down payment.

Is There a Tax Benefit to the Down Payment Gift-Giver?

No, not really. As a matter of fact, the gift giver could incur an extra gift tax from the IRS if they were to go over the annual exclusion amount for a gift.

In short, as long as you don’t gift more than $15,000 as an individual, or $30,000 as a joint tax-filing couple, you will not be hit with a gift tax. But you would want to talk to a tax professional just to make sure.

How Much Is the Gift Tax?

This is where it can get a little convoluted and confusing. There is another piece of the puzzle called the lifetime gift tax exemption. This is a number, currently just over $11.5 million, that you can gift up to in your lifetime. But wait—it’s not that simple.

As long as you stay under the annual gift exemption amount, the lifetime exemption doesn’t come into play. If you were to exceed the annual allowable gift amount, the overage would be deducted from your lifetime gift total, leaving you with less than you can gift without being taxed on it.

For example, if you were to gift someone $30,000 as an individual, you would be $15,000 over your annual allowable gift-giving allotment. That extra $15,000 would be deducted from your lifetime allotment, lowering the total amount that you can gift over the course of your life.

It is also worth noting that when you do exceed the annual limit, you have to file IRS Form 709, letting them know that you have gone over the allowable down payment gift. This is something that your accountant will be able to take care of for you at the end of the year.

Crowdsourcing as an Another Alternative

With platforms like Kickstarter and Indiegogo becoming so popular, it is no wonder that crowdsourcing has made its way into the home purchasing space. Some popular sites to crowdsource your down payment are HomeFundit and FeatherTheNest.

What Is Down Payment Assistance?

Believe it or not, there are programs out there designed to help you put a payment down on a home you would like to purchase. This program is called the Down Payment Assistance program (DPA).

Each state has its own separate entities that take care of the down payment assistance programs. Less populated states have fewer programs (like Idaho with only two). Other states that are far more populated have many more programs (like California with 357).

How Do I Qualify for Down Payment Assistance?

The exact rules for how to qualify depend on the state that you live in and the program you’re applying for. Some programs cater to specific groups, such as first responders, nurses, or veterans. Other programs care only about how much money you bring in annually.

In order to find out if you qualify, you really have to do some research into the programs that are offered by your state.

Do I Have to Be a First-Time Homebuyer to Qualify for Down Payment Assistance?

You do have to be a first-time homebuyer in order to qualify for most of the programs. Fortunately, according to Housing and Urban Development (HUD), being a first-time homebuyer just means that you haven’t had any ownership in a primary residence within the last three years.

So, if you owned a home that you sold five years ago and have been renting ever since, congratulations! You would be classified as a first-time homebuyer and qualify for many down payment assistance programs.

How Much Should You Put Down on a House?

On average, homebuyers are putting down 12% of the home’s purchase price as a down payment, with first-time homebuyers putting down a mere 6%. But there are more options for zero money down and options as low as 3.5% down payments.

Does that mean that if you have saved up $18,000 you are ready to go out and purchase a $300,000 by putting 6% down? Not necessarily. Before you can decide how much you really want to put down, there are more questions that you need to have answered.

How Much Does My Down Payment Need to Be?

The answer to this question, again, is not cut and dry. How much you need to put down on a home depends on the loan product that you are trying to use. Products like VA loans or USDA home loans offer no money down options. If you don’t qualify for one of those loans, a down payment on an FHA loan, which is backed by the Federal Housing Authority, can be as little as 3.5%.

For certain loan products, and for conventional loans where you make a down payment of less than 20%, you are susceptible to having mortgage insurance added into your monthly mortgage payment.

What Is Mortgage Insurance, and How Do I Get Rid of It?

Mortgage insurance is an extra payment that a borrower is required to pay monthly in addition to the mortgage payment they owe their lender. Mortgage insurance is designed to protect the lender in case the borrower stops making payments and defaults on the loan. In a borrower defaults on the loan, the lender gets a portion of the overall principal left on the loan paid to them by a mortgage insurer.

For the time being, the only way that you can really avoid paying mortgage insurance is to make a down payment of 20% or more toward the home purchase.

Why & How Your Credit Score Factors In

Your credit score will affect the interest rate that you are going to be approved for, but it might also affect how much you need to put down.

If you are applying for an FHA loan and have a score over 580, you should be able to qualify with only a 3.5% down payment. However, if your score is under 580 and you are able to qualify for the loan, you will have to put down 10%.

Pros to Making a Bigger Down Payment

Pay Less for Your House

Interest on your mortgage is simple interest. This means that your interest is not compounded, or cannot gain interest on itself. Even though a mortgage uses simple interest, the interest still adds up very quickly over the course of your home loan. By making a larger down payment, you are effectively reducing the amount that you will ultimately pay for the home.

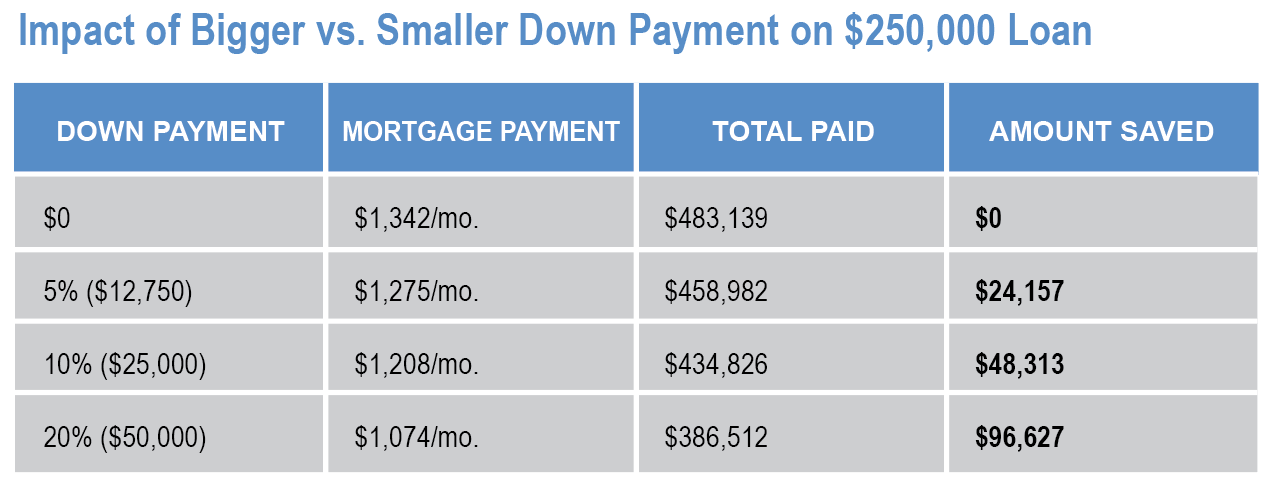

The following example uses the median home price in the United States of $250,000 and shows how putting different amounts down can lower your overall payment for your home. In the example below, we use a 30-year fixed-rate loan of 5%.

Down Payment Interest Savings Example

Taking out a loan for $250,000 would leave you with a mortgage-only payment of $1,342 per month. Over the life of that loan, if you paid your mortgage on time and put nothing else toward the principal of the loan, you would end up paying $483,139.

We will now run the numbers with a 5, 10, and 20% down payment.

At 5% ($12,750), you pay $1,275 per month, leading to $458,982 total. A 10% down payment ($25,000) would equate to a monthly mortgage of $1,208 with the total amount paid being $434,826. Putting 20% down ($50,000) would mean a monthly payment of $1,074 and a total payoff of $386,512.

You would save $24,157, $48,313, or $96,627, respectively, depending on which down payment you make. That is almost a 100% return on your investment.

Lower Your Interest Rate

Lenders are more likely to give you a better interest rate when putting down 20% compared to 5%.

Reduce Your Monthly Mortgage Payment

It doesn’t take a math whiz to realize that by lowering the total loan amount and paying less interest, you will be required to pay less each month. When comparing a 5% and 20% down payment on a $200,000 home, you can easily see that the higher down payment lowers your monthly mortgage significantly.

It’s true that for a 5% mortgage interest rate, each $1,000 you put down will only lower your mortgage by about five bucks. But leaving that same $1,000 just sitting in the bank is going to do a lot less for your wallet.

Higher Chance of Offer Being Accepted

This one may be a little more mythical than numerical, but it still carries weight. When faced with the decision between two offers on their home, where the only difference is the amount of the down payment, a seller is much more likely to choose the offer with the higher down payment. This is just due to the fact that the buyer putting down more looks more credible in the sellers’ eyes and less likely to have problems throughout the loan process.

Is this necessarily the truth? No, but that’s just the way it is. If a seller is looking at multiple offers, they are going to be most attracted to the one that they think can get to the closing table on time, ready to close the deal.

This is even more true when you are looking to purchase a home in a competitive market at a competitive price point.

Pros to Making a Smaller Down Payment

Get Into a Home Quicker

Saving is difficult. It can be very slow-going and painful.

When you are trying to purchase a home, the last thing you want to do is wait years and years to build up enough in a savings account for a large down payment. By putting less down, you will be able to get into a home quicker.

Leave More in Savings as Emergency Fund

All things being equal, by putting less money toward your down payment, you will be able to keep more in your savings account. This means that if anything were to happen to your income stream, you won’t be as at-risk of defaulting on your home loan.

What to Consider When Determining How Much to Put Down on a Home

I am sorry to say that this isn’t a simple question I can answer for you. There are too many factors at play when it comes to deciding. I can, however, help you think through things and arrive at an answer.

How Much Do You Have Saved?

This is not a question of if you’ve saved enough for a down payment. This is a question of completely depleting your savings. How much will you have left after making the down payment? The last thing that you would want is to save up all this money, get settled into your home, and then have an emergency happen that you couldn’t afford to pay for because all of your money is tied up in your home.

Putting 20% down is probably not the best choice for you if it is going to leave you with little to nothing in your savings account afterward. You are going to be much safer financially if you put a little bit less down, bite the bullet of taking on mortgage insurance, and work toward getting to that 20% equity mark (in which case you’d be let off the hook for the mortgage insurance).

How Long Are You Planning to Live in the Home?

The longer that you plan on staying in the home, the more valuable each dollar of down payment becomes. Some of the benefits of putting a larger down payment down don’t occur until you have lived in the home for many years.

If you are planning on living in the home for less than 10 years, then making a larger down payment may not be the best choice for you.

What Size Monthly Mortgage Payment Can You Support?

If you have a lot of money saved up for a down payment but you don’t have enough each month to support a higher mortgage payment, then putting more of that savings down is a good idea. This is especially true if putting more down is going to save you from mortgage insurance.

When you put more down to save the mortgage insurance, you are lowering your monthly payment twofold. You lower it by getting rid of the mortgage insurance and by lowering the overall loan amount that you are taking out.

Conclusion: It’s Not as Simple as One Would Hope

As you can see, answering the question as to how much you should put down on a home is not the easiest thing to do. There are many variables that you need to account for to be able to make the best decision for your specific needs. Regardless, hopefully, you came out on the other side of this novel knowing at least a little bit more about down payments (and closing costs!) and are able to make a more informed decision. Talk to a real estate agent and your mortgage specialist for their advice and council.

Good luck, and happy home buying!